DISCOVER DISPUTE CHARGE FREE

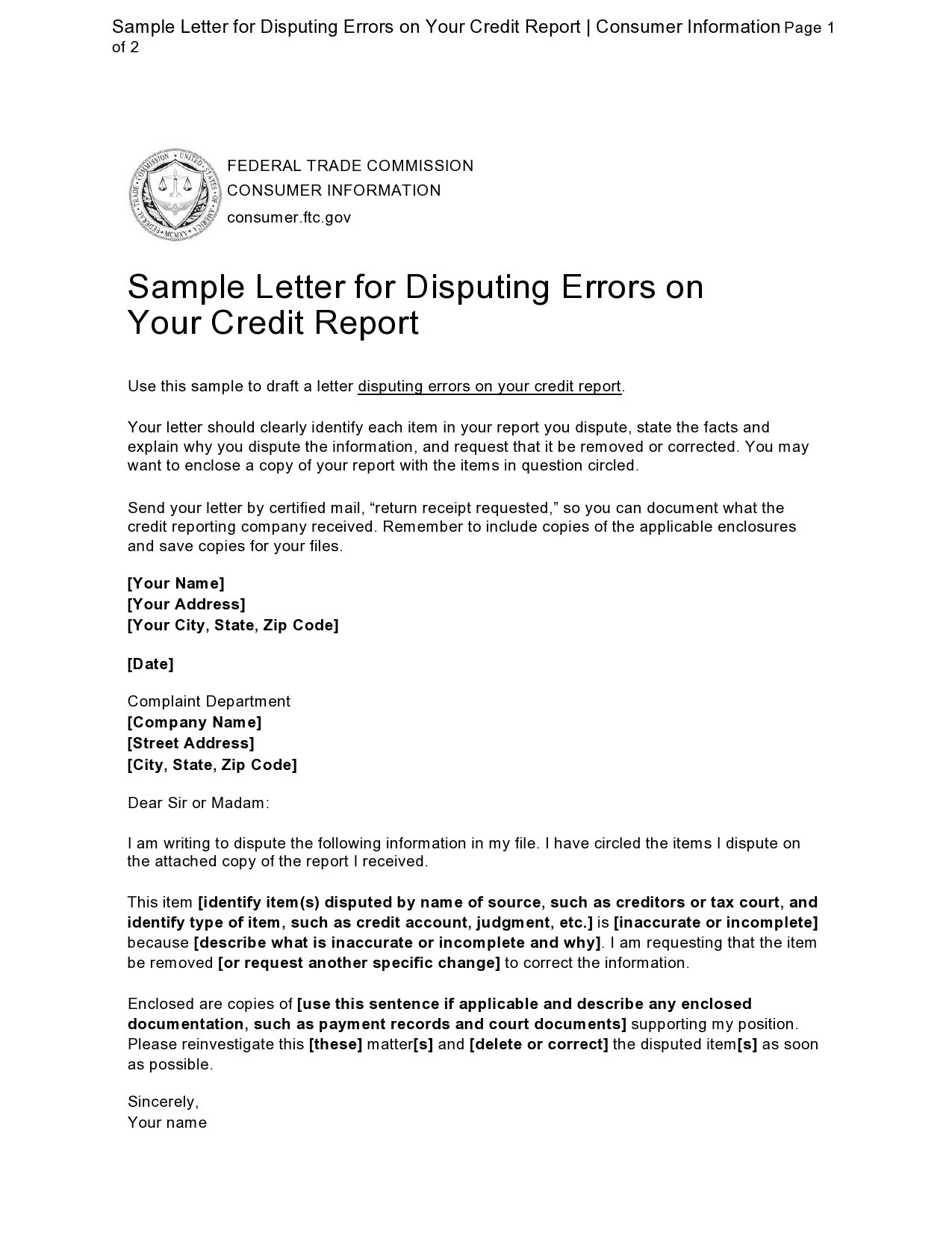

It’s helpful to make sure that all of the information on your file is correct by making a habit of checking your credit report and quickly disputing errors.ĭiscover® Cardmembers get a free Credit Scorecard with their updated FICO® Score every month and important information like credit utilization, number of missed payments, number of recent inquiries, length of credit history and total number of accounts. This is why it’s a good idea to regularly check your credit report: doing so can help you find and report fraudulent activity (if someone opened an account in your name without your permission) or a mistake in your creditor’s reporting. Some employers even use credit reports in their hiring decisions. This is because credit reporting companies share the information in your credit report with businesses who then use the report to decide whether to give you a loan, offer you insurance, or approve you for a mortgage. You may be saddled with higher interest rates if the errors on your report lead to a lower credit score. If left unchecked, errors on your credit report may affect your spending power and ability to get anything from a personal loan to a credit card. A delinquent or late payment reported on an account that was paid on time.Derogatory marks that are older than seven years.Reporting errors on your credit report is so important because wrong information on your file may affect your credit score, which can have longer-lasting implications.Įxamples of errors that may affect your credit score include: Reasons to dispute credit report information With the right tools in hand, you can proactively check your credit report and dispute any errors to the credit bureaus. Under the Fair Credit Reporting Act, you have the right to get free credit reports from all three major credit bureaus every 12 months. law gives you the right to dispute any incorrect information on your credit report at all the three major reporting agencies (Experian, Equifax, and TransUnion) and through your creditors directly.

These kinds of errors, if left unchecked, may have a big impact on whether you get credit in the future.

DISCOVER DISPUTE CHARGE UPDATE

Some are simple, like a creditor who didn’t update your file-and others can be more serious, like credit card fraud. There are a few reasons why an error may have made its way to your credit report. Checking your credit report and finding a mistake, or worse yet, an account you don’t recognize, can be a troubling experience. Your credit report is one of the most important documents that you can have, right up there with your passport or driver’s license, but it isn’t always a document free of errors. If you want to build your credit or at least maintain it, it’s always a good idea to review your credit report. To dispute an error on your credit report, contact both the credit reporting company and the company that provided the disputed information. Inaccurate information in your credit report may affect your ability to get credit in the future. Errors on your credit report can happen due to a creditor not updating your info or it can be a sign of identity theft.

0 kommentar(er)

0 kommentar(er)